[ad_1]

Last month, the Federal Reserve released a new report: Economic Well-Being of U.S. Households in 2021 [PDF]. This annual survey gauges American financial health and attitudes. The 2021 edition was conducted last November.

Here are some highlights from the report:

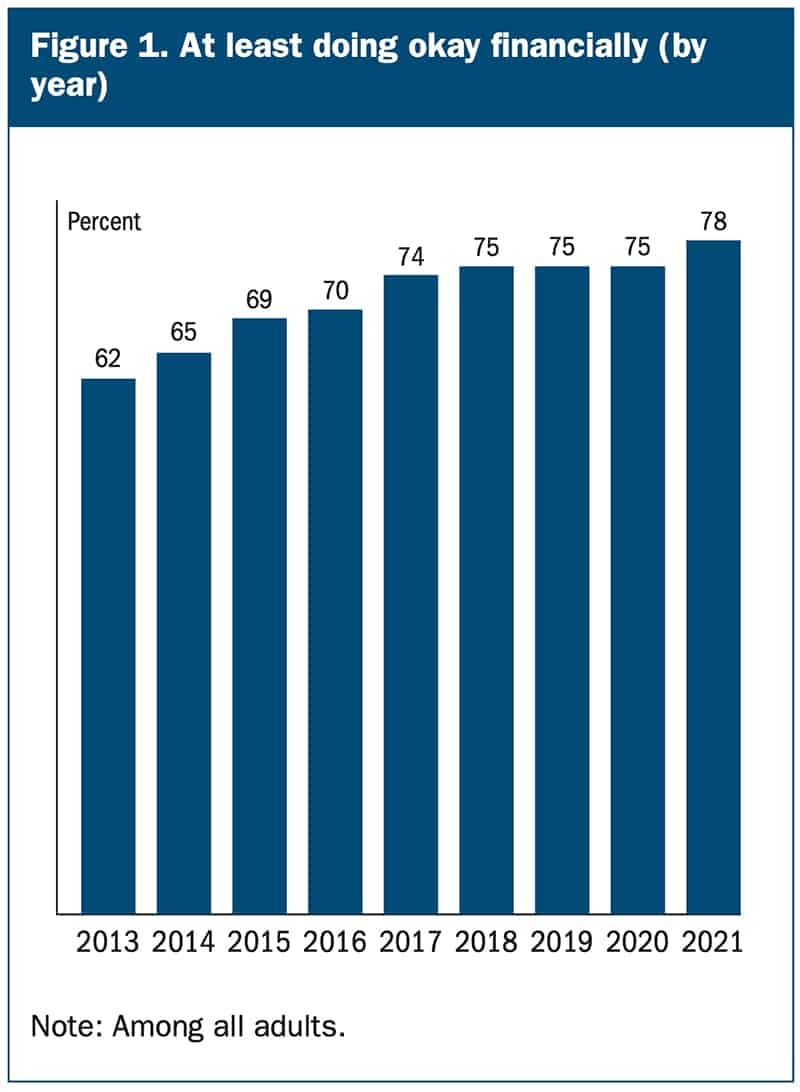

- Seventy-eight percent of adults were either doing okay or living comfortably financially, the highest share with this level of financial well-being since the survey began in 2013.

- Fifteen percent of adults with income less than $50,000 struggled to pay their bills because of varying monthly income.

- Fifteen percent of workers said they were in a different job than twelve months earlier. Just over six in ten people who changed jobs said their new job was better overall, compared with one in ten who said that it was worse.

- Sixty-eight percent of adults said they would cover a $400 emergency expense exclusively using cash or its equivalent, up from 50 percent who would pay this way when the survey began in 2013. (Note that this survey is the original source of this oft-quoted statistic.)

- Six percent of adults did not have a bank account. Eleven percent of adults with a bank account paid an overdraft fee in the previous twelve months.

These little nuggets of info are interesting, sure, but what I find even more interesting are the charts and graphs documenting long-term trends.

The Demographics of Economic Well-Being

Here, for instance, is a chart that shows how people feel about their current financial situation:

In 2021, 78% of adults in this country reported “doing okay” or “living comfortably”. That’s up significantly from when this survey started in 2013.

The next logical question, of course, is how different demographics feel about their financial situation. The Fed report offers some insight into that.

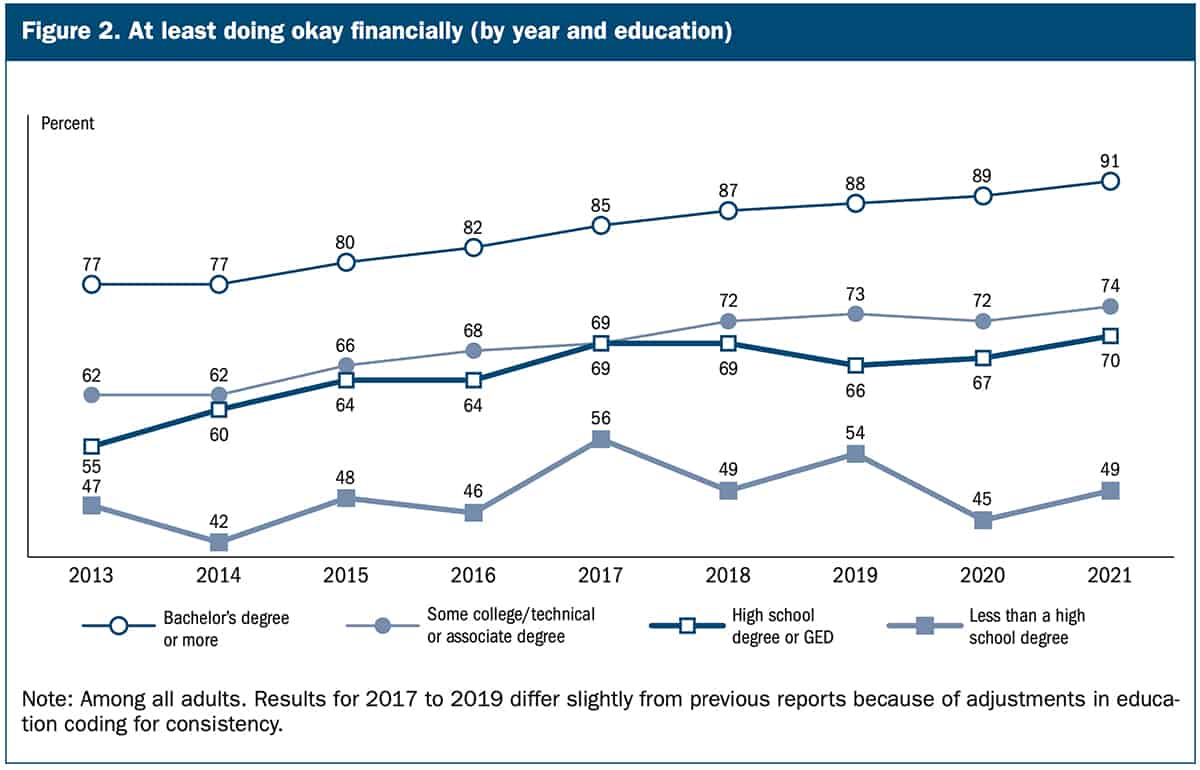

Here’s a chart that shows (once again) the value of a college degree).

Although it’s popular in some corners to bad-mouth college degrees, according to the U.S. Census Bureau (and many other sources) your education has a greater impact on lifetime earning potential than any other demographic factor. Education matters more than age. Education matters more than race. Education matters more than gender. When it comes to making money, education matters most.

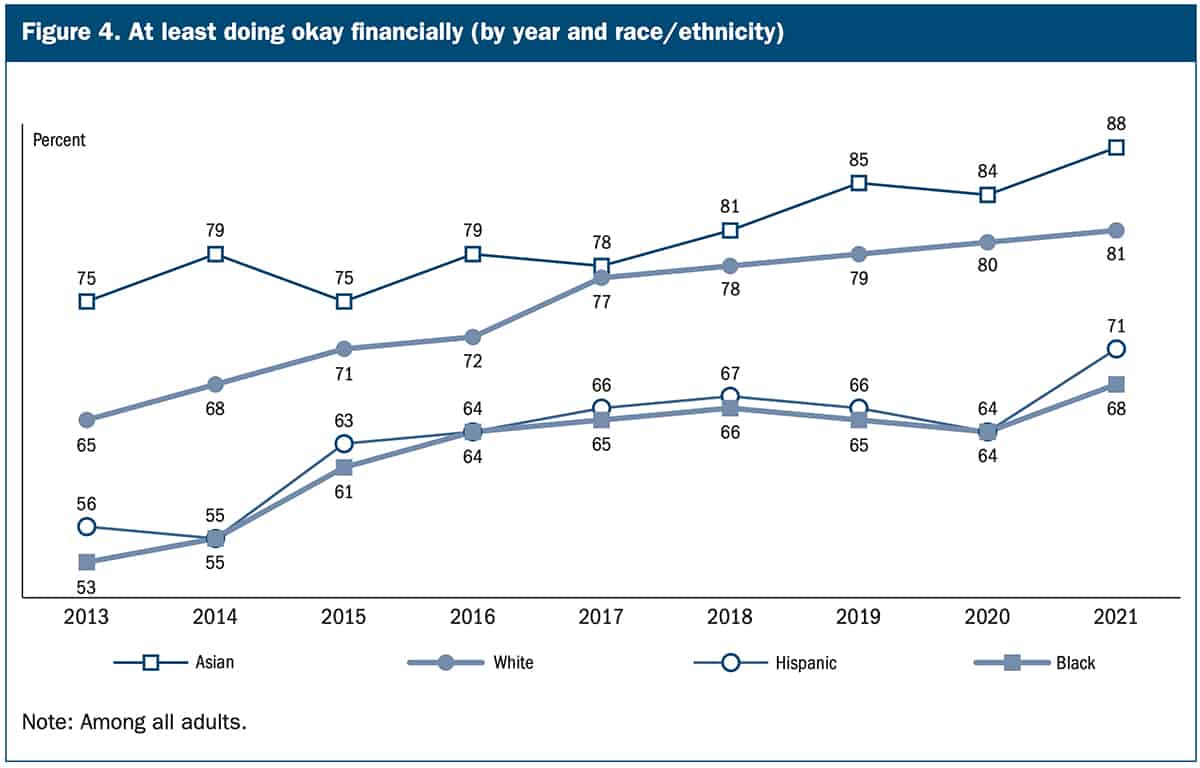

Next, here’s a chart from the Fed report that documents economic well-being by race and ethnicity:

It seems that economic well-being has improved across the board during the past decade.

Personal Well-Being Versus National Well-Being

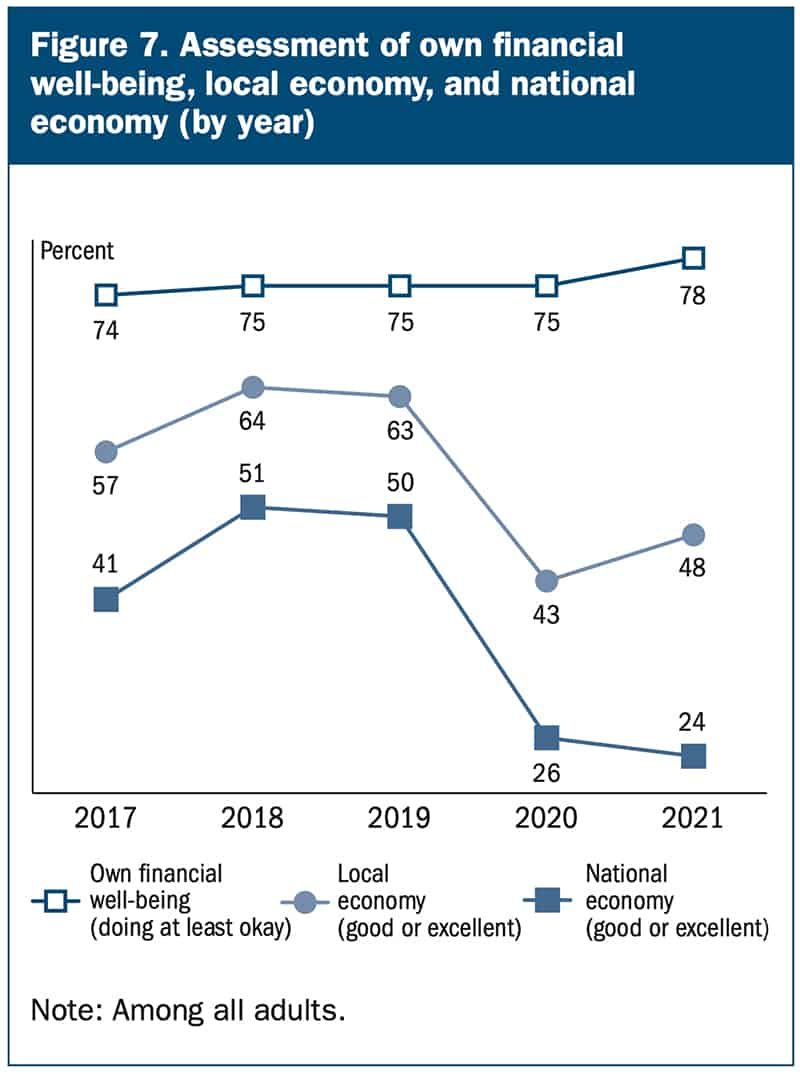

To me, however, the most interesting chart is this one, which compares respondents’ assessments of their personal well-being with their assessment of local and national economies. Look at this chart and tell me what you make of it. (I have an opinion, but I want you to develop your own hypothesis before reading mine…)

From the report:

Similar to people’s perceptions of their local economy, the share rating the national economy favorably fell precipitously from 2019 to 2020, after the onset of the pandemic ). However, people’s perceptions of the national economy continued to decline in 2021. Only 24 percent of adults rated the national economy as ‘good’ or ‘excellent’ in 2021, down 2 percentage points from 2020 and about half the rate seen in 2019. This trend contrasts starkly with people’s increasingly favorable assessment of their own financial well-being.

The Fed report tells us this discrepancy exists but it doesn’t tell us why it exists. Why do 78% of Americans say that their own financial situation is at least okay, but nearly the same number believe that the national economy isn’t doing well? I don’t know. But I can think of two possible reasons.

First, perhaps most Americans have learned to manage money. Perhaps they’ve been reading money blogs and listening to money podcasts, and now the lessons have sunk in. Maybe they’ve begun saving and investing wisely over the past fifteen years so that their personal economy is now protected from the gyrations of the economy at large.

Perhaps.

I harbor a suspicion, however, that there’s something else at play here.

Long-time readers know how much I abhor the news media. The mass media does not report reality. If you envision life as a bell curve (or “normal distribution”, if you prefer), the mass media tends to report solely outlier events — especially negative outlier events. The vast majority of our lives comprise normal, positive, healthy interactions and relationships and conditions. The news doesn’t report these.

In this case, I can’t help but wonder whether this disparity between perceptions of personal economic well-being and national economic well-being are driven (at least in part) by negative economic news, news that highlights the problems with our economy rather than the things that are going right.

That’s what I think. What do you think? What’s the reason for this gap in perception?

Final Thoughts

There’s much more data and insight in this 92-page report. I’ve highlighted only some stats from the first section on overall financial well-being. Other sections cover income, employment, unexpected expenses, banking and credit, housing, education, student loans, retirement and investments, and more.

I found the section on student loans interesting too. It contains a number of insights. Borrowers with less education, for example, are more likely to be behind on loan payments. This makes some sense, I think. Meanwhile, fewer people are behind on payments than two years ago (and this applies across all demographics).

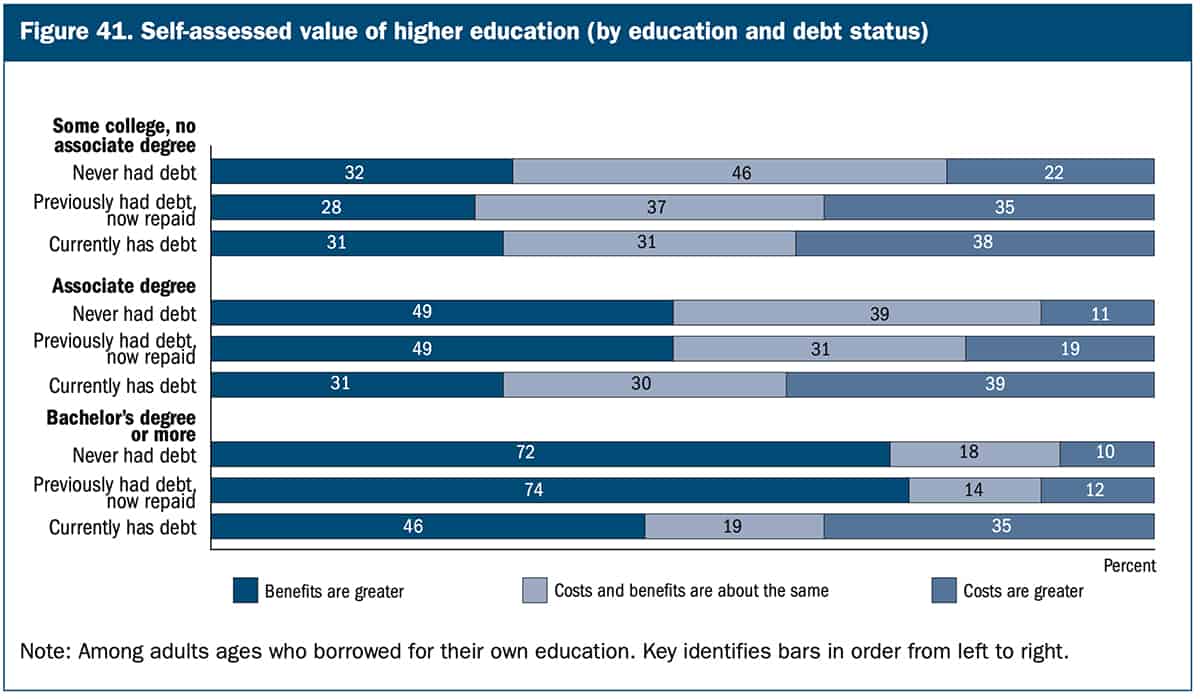

Here, though, is my favorite chart from the entire report. It measures the self-assessed value of higher education:

Two things seem clear here. First, folks who never had to borrow for college believe their education is worth more. Second, the more education one obtains, the more valuable it seems.

Okay, a third thing. Compare this chart with the one I shared earlier that highlights financial well-being by level of education. It’s clear that (objectively) education does improve financial health. But those who have student loans can’t always see that. Their subjective experience seems to contradict the data. Interesting…

Anyhow, the Fed’s Economic Well-Being of U.S. Households in 2021 is filled with interesting info. It’s worth reading (or skimming) the next time you sit down to waste time on the internet!

[ad_2]

Source link